When calulating an individual person's financial risk and viability, we look at his/her debt to income level (DTI), but when talking about a country we always look at debt to GDP.

However, is this valid?

Every dollar government borrows and spends makes the GDP go up.

This is akin to looking at an individual person and counting everything he has purchased with his credit cards as "income".

(Also, the GDP is not the Government's income. It is ours. As soon as the government starts creating something of value and selling it at a profit, it can count it as it's income.)

Saturday, December 26, 2009

Friday, December 11, 2009

Liberty and Tyranny

"We all declare for liberty; but in using the same word we do not all mean the same thing. With some the word liberty may mean for each man to do as he pleases with himself, and the product of his labor; while with others, the same word may mean for some men to do as they please with other men, and the product of other men's labor. Here are two, not only different, but incompatible things, called by the same name - liberty. And it follows that each of the things is, by the respective parties, called by two different and incompatible names -liberty and tyranny."

The Collected Works of Abraham Lincoln edited by Roy P. Basler, Volume VII, "Address at Sanitary Fair, Baltimore, Maryland" (April 18, 1864), p. 301-302.

What an amazing quote...

Thursday, December 3, 2009

Zimbabwe Ben

Labels:

Bailouts,

Banking,

Economic Collapse,

Economics,

FED,

Government,

Money Management,

Ron Paul,

stimulus

Gold Thoughts: Arnold Bock

The following is Copyright © 2009 Arnold Bock and can be found over at Financial Sense.

So why am I so optimistic about the eventual price of gold?

So why am I so optimistic about the eventual price of gold?

It is because an affinity for and an understanding of the political mindset causes me to understand what decision makers will do…and why. Because a politician follows the political calendar, s/he only concerns himself/herself with the time horizon leading to the next election.

Anything requiring decisions beyond the date of the next election will be the responsibility of whoever is on the next watch. If the politician in office today is in office after the next election, a shrug of the shoulder indicates that worries of that kind can be dismissed for now to be dealt with later.

So major and difficult, but necessary, decisions are inevitably deferred. In their place spending money gives the appearance of concern and of doing something to fix the apparent problem. Aren’t those elected officials doing what we elected them to do? It certainly looks as if they are.

More cynical observers would characterize these actions by the political class and their senior bureaucratic minions as buying time hoping that something positive might magically emerge.

Those who are super cynical would even conclude give-away programs are designed simply to bribe the voters in order to curry goodwill for another term at the levers of power.

What all this means is that there is no discipline or inclination to do anything of real value in fixing the core economic and financial problems. That being the case, new programs, more spending stimulus and money creation will always be the order of the day. Hence the currency will devalue and investors will find gold as their best safe-haven refuge.

The dollar will devalue because massive dilution caused by incessant money creation allows future obligations to become more manageable – for government – because it is the only way that it can meet its future obligations for employee pensions, accumulated debt, Medicare and social security.

A nominal dollar which buys much less in the future than it does today is still a dollar. Unfortunately the holders or recipients of those devalued pieces of paper will find they are essentially fraudulent promises.

These realities make gold the closest thing to a sure-bet investment. They are also the reasons why gold will go much higher than most of us allow ourselves to contemplate.

Buckle your seatbelts and enjoy the ride ahead!

I still think Gold is overbought, it is always a good reminder to keep myself honest by reading stuff like this. I have a lot of events coming up this year wedding, honeymoon, trying to buy house, etc...With all these I am going to need liquidity and not sure holding on to bullion is going to be my best option. I am looking to buy some on the dip (if that ever happens) think I might as well get into som Sliver and Oil.

Labels:

Atlas Shrugged,

Bailouts,

bribes,

Currency,

Debt,

Economic Collapse,

FED,

Gold,

Government,

investments,

Money,

Money Management,

stimulus

Tuesday, December 1, 2009

November 09 Net Worth: Not Much Changing

November was a another solid month with a 5.89% growth. I am looking forward to breaking down my yearly net worth in January. I didn't do to much this month and don't really see December being an exciting month, as I am going to ride it out the rest of the year, unless gold has a strong decline.

November was a another solid month with a 5.89% growth. I am looking forward to breaking down my yearly net worth in January. I didn't do to much this month and don't really see December being an exciting month, as I am going to ride it out the rest of the year, unless gold has a strong decline.Lets break it down:

Cash & Savings: Saw only a small jump this month as we added some cash into our brokerage account. I still do not see much growth in this area over the next 4-5 months with all the wedding and honeymoon stuff that we will have to pay for. This bracket holds the funds for my down payment on house(which is pushed back another year), engagement ring, insurance, auto maintenance, Roth IRA(before I max it out), and vacation. This is why it can be a little deceiving, it also holds my monthly budget in it. It has about 16-17k sitting around as savings the rest are funds that are going to be used at some point over the year. The rest is used on a daily bases for covering expenses, rent, food, auto, etc...

Stocks/Brokerage: As you can see I sold all my stocks this month. Most all of that $688 is all shorting the financials/stock market and the rest sitting in cash in my brokerage account.

Precious Metals: All the money from selling my stocks I bought gold stocks and looking to buy more on the dip, which we just had, but did not pull the trigger.

Retirement 401k: This braket is just me adding money to my 401k every month. Not seeing much growth here this last month. I not really checking on this bracket as it really long term and I just keep pumping money into it every paycheck.

Retirement IRA's: I have finally moved all my IRA/Roth IRA into the same bracket. I still have a big chunk of cash sitting on the sidelines which will hopefully be maxed out before April 15th. If I still think the market is going to correct itself I will keep it on the sidelines and just try and max out my fiancés and my Roth's next year.

Debts and Liabilities - Vehicle and Credit still high

Credit Cards: All of this is still the engagement credit card with a 12 month 0% APR, I am not going to put much of a dent into this debt until the 12 month or January/February, when I will pay it off in full. I have that money going straight into my saving account creating a little interest off of it till I pay it in full.

Car Loan: I am paying 4% APR on it so I am paying a little but not a ton. Still looking to pay it off early-will probably be a goal next year.

November was great month. It was the third month in a row with positive gain, and five out of last six months, so I cannot complain, especially since this is through this recession.

Retirement 401k: This braket is just me adding money to my 401k every month. Not seeing much growth here this last month. I not really checking on this bracket as it really long term and I just keep pumping money into it every paycheck.

Retirement IRA's: I have finally moved all my IRA/Roth IRA into the same bracket. I still have a big chunk of cash sitting on the sidelines which will hopefully be maxed out before April 15th. If I still think the market is going to correct itself I will keep it on the sidelines and just try and max out my fiancés and my Roth's next year.

Debts and Liabilities - Vehicle and Credit still high

Credit Cards: All of this is still the engagement credit card with a 12 month 0% APR, I am not going to put much of a dent into this debt until the 12 month or January/February, when I will pay it off in full. I have that money going straight into my saving account creating a little interest off of it till I pay it in full.

Car Loan: I am paying 4% APR on it so I am paying a little but not a ton. Still looking to pay it off early-will probably be a goal next year.

November was great month. It was the third month in a row with positive gain, and five out of last six months, so I cannot complain, especially since this is through this recession.

Thursday, November 26, 2009

Gold and Money - Atlas Shrugged

"Money is the barometer of a society's virtue. When you see that trading is done, not by consent, but by compulsion--when you see that in order to produce, you need to obtain permission from men who produce nothing--when you see that money is flowing to those who deal, not in goods, but in favors--when you see that men get richer by graft and by pull than by work, and your laws don't protect you against them, but protect them against you--when you see corruption being rewarded and honesty becoming a self-sacrifice--you may know that your society is doomed. Money is so noble a medium that is does not compete with guns and it does not make terms with brutality. It will not permit a country to survive as half-property, half-loot.

Whenever destroyers appear among men, they start by destroying money, for money is men's protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked, 'Account overdrawn.' "

"Francisco's Money Speech" by Ayn Rand

Whenever destroyers appear among men, they start by destroying money, for money is men's protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked, 'Account overdrawn.' "

"Francisco's Money Speech" by Ayn Rand

Wednesday, November 25, 2009

National Debt

We recently just passed $12 trillion, keep stepping on that gas administration, no one is watching, we are all to busy watching American Idol and enjoying the recovery...

Total: $12,030,203,408,433.00

Debt Per Person: $39,058.00

Debt Per Taxpayer: $110,681.00

Labels:

Bailouts,

budget,

Debt,

Economic Collapse,

Government,

kids,

life,

Money Management,

responsibility,

stimulus

Tuesday, November 24, 2009

Timing the Market

Friday, November 20, 2009

The Vampire Squid and Their Politicians

Can I rant for just a second? Please take a good look at this list of Representatives who voted nay on an amendment offered by Rep. Ron Paul (R., Texas) to give federal watchdogs massive new authority to audit the Federal Reserve. If they are in your State/District please do all you can do to make sure they are not re-elected. I am sorry, they do not deserve the right to serve this great country one more day. It is laughable that Barney Frank is still in office, I would be ashamed if I lived in Massachusetts.

The Federal Reserve is robbing Americans right in front of our faces and our politicians are allowing for it to happen. Here are a list of the these politicians who are in bed with the Federal Reserve:

CA-42 Rep. Gary G. Miller

CA-43 Rep. Joe Baca

CT-04 Rep. Jim Himes

FL-22 Rep. Ron Klein

IL-04 Rep. Luis V. Gutierrez

IL-08 Rep. Melissa L. Bean

IL-14 Rep. Bill Foster

IN-02 Rep. Joe Donnelly

IN-07 Rep. Andre Carson

KS-03 Rep. Dennis Moore

MA-04 Rep. Barney Frank

MA-08 Rep. Michael E. Capuano

MA-09 Rep. Stephen F. Lynch

MN-05 Rep. Keith Ellison

NC-12 Rep. Melvin L. Watt

NC-13 Rep. Brad Miller

NY-05 Rep. Gary L. Ackerman

NY-06 Rep. Gregory W. Meeks

NY-14 Rep. Carolyn B. Maloney

OH-06 Rep. Charles Wilson

OH-15 Rep. Mary Jo Kilroy

TX-09 Rep. Al Green

WI-04 Rep. Gwen Moore

WV-02 Rep. Shelley Moore Capito

Labels:

Atlas Shrugged,

Debt,

Economic Collapse,

FED,

Government,

Money Management,

Peter Schiff,

Ron Paul

Wednesday, November 18, 2009

Comment by Cognitive Dissonance

This post is from a regular reader By the name of Cognitive Dissonance over at Zero Hedge, and thought I would share it with you:

This post is about

by Cognitive Dissonance

on Wed, 11/18/2009 - 16:47

This post is about

by Cognitive Dissonance

on Wed, 11/18/2009 - 16:47

I am convinced more and more every day this bill is DOA. They simply can’t let this pass in any form whatsoever other than purely ceremonial. The Ponzi can't be exposed to the light of the day for it will not survive.This is how I try to approach thing when speaking with people about this, but I am not doing so well at it? I will keep trying though as it is the only way to make it stop is to reach we the people.

As I've talked about repeatedly, all Americans (not just corporate or white collar, but blue and green collar as well) have been deep captured by the Ponzi. Their future is wrapped up in their homes, their 40(k)’s and their public and private pensions. They knew deep down inside their hearts this train ride would end some day and they’re sick to death that time might be now. And they don’t wish to face that truth.

Given the choice of exposure now, causing asset classes to drop like a rock when the true extent of the corruption, counterfeit Treasuries and MBS, blatant influence peddling by the Fed and so on (followed by what I believe will be slow but sustainable growth over 10 years) or the slow melt down into deep recession/depression most people hope and pray will be the preferred outcome (unless you are a double shot espresso Kool-Aid drinker and you believe nirvana is around the corner) the choice is obvious. Do nothing and hope for the best.

We The People are addicted to false hope because false hopes bind us to impossible conditions and situations. As long as we can convince ourselves that recovery is just around the corner, we won't do the really hard work required to stop this madness, cut out the corruption and filth and get on with building a more sustainable world.

It’s just not going to happen until people want it to happen. I beg everyone to work on the people you know who are in denial. Don't give them huge doses of reality all at once because they’ll simply turn you off like the TV. And don't talk at them. Please don’t point the finger at them and say you should know this or that. It’s poison and all it’ll get you is hostility.

Present your ideas as a narrative about yourself and your own personal road to understanding and awareness. Tell them “I used to believe this about the world but when I began to look in some uncomfortable places, I found this and that.” People have a tendency to listen if they don't feel they’re being lectured to, that the speaker is exposing a personal, hidden and vulnerable side to the listener. Allow the listener to feel empathy towards you rather than force the listener deeper into his or her denial. Seduce them with an honest look at yourself by yourself.

It works. I do it all the time and people listen. Don't make yourself out as a hero for learning the truth. Expose yourself as a reluctant truth seeker who was shocked and saddened by what you found. But now that the shock has worn off, you’re even more determined to stop the insanity. I suspect you won’t need to lie about that fact.

Focus on 5 people and slowly spread the word. It’s our only hope folks.

Monday, November 16, 2009

Reading on Gold/Money/Fed/Dollar

There is a great guest post over at Weakonomics on Money, Gold, the FED, and why you should be concerned about the US Dollar. It is written by askmrcreditcard who has guest posted on my site before. Check it out, in the meantime I am waiting and hoping that gold comes back down around the 1000.00 mark and will purchase some if so.

Friday, November 13, 2009

Wednesday, November 4, 2009

House Gambles with Economic Future

Visit msnbc.com for Breaking News, World News, and News about the Economy

Dylan's four (shockingly logical) proposals on how to fix the broken financial system:

Inject transparency, primarily to bring almost $500 trillion in swaps to the forefront.

Capital to back Wall Street's gambling. It is a guarantee that very few firms will have Goldman's trading pattern each and every quarter.

Enact a tax-code to discourage short-term profits. "Fortunes should not be made in minutes but over years through the creation of value to society."

Break up the Too Big To Fail banking institutions. Start with Goldman Sachs. Right Now. Christine Varney, we are still looking at you.

Labels:

Atlas Shrugged,

Bailouts,

Banking,

Economic Collapse,

Economics,

Government,

Lessons,

responsibility,

taxes

Monday, November 2, 2009

October 09 Net Worth: Out of Equities into Precious Metals

October was a another good month for me, my net worth was up 10% and broke the 40k mark—50k is on deck with 100k sometime soon!

October was a another good month for me, my net worth was up 10% and broke the 40k mark—50k is on deck with 100k sometime soon!Lets break it down:

Cash & Savings: We saw cash saving jump up 3k mostly because of a bonus at work, I am so blessed that my company is doing well at the moment with all that is going on with this economy. I still do not see much growth in this area over the next 4-5 months with all the wedding and honeymoon stuff that we will have to pay for. This bracket holds the funds for my down payment on house(which is pushed back another year), engagement ring, insurance, auto maintenance, Roth IRA(before I max it out), and vacation. This is why it can be a little deceiving, it also holds my monthly budget in it. It has about 16-17k sitting around as savings the rest are funds that are going to be used at some point over the year. The rest is used on a daily bases for covering expenses, rent, food, auto, etc...

Stocks/Brokerage: As you can see I sold all my stocks this month. Most all of that $688 is all shorting the financials/stock market and the rest sitting in cash in my brokerage account.

Precious Metals: All the money from selling my stocks I bought gold stocks(see previous post)

Retirement 401k: This braket is just me adding money to my 401k every month. Not seeing much growth here this last month. I not really checking on this bracket as it really long term and I just keep pumping money into it every paycheck.

Retirement IRA's: Overall I lost money this month with my Roth as I have started to dollar cost averaging in to max it out the rest of the year. I still have a big chunk of cash sitting on the sidelines which will hopefully be maxed out before April 15th. If I still think the market is going to correct itself I will keep it on the sidelines and just try and max out my fiancés and my Roth's next year.

Debts and Liabilities - Vehicle and Credit still high

Credit Cards: All of this is still the engagement credit card with a 12 month 0% APR, I am not going to put much of a dent into this debt until the 12 month or January/February, when I will pay it off in full. I have that money going straight into my saving account creating a little interest off of it till I pay it in full.

Car Loan: See last month with starting to think abut paying it off in full at some point—This will probably be next year, as I don't want to take that big of chunk of saving out for it t the moment. I am paying 4% APR on it so I am paying a little but not a ton. Still looking to pay it off early-will probably be a goal next ear.

So overall October was a good month. Still kicking up the saving as I have wedding and honeymoon expenses coming down the line.

Retirement 401k: This braket is just me adding money to my 401k every month. Not seeing much growth here this last month. I not really checking on this bracket as it really long term and I just keep pumping money into it every paycheck.

Retirement IRA's: Overall I lost money this month with my Roth as I have started to dollar cost averaging in to max it out the rest of the year. I still have a big chunk of cash sitting on the sidelines which will hopefully be maxed out before April 15th. If I still think the market is going to correct itself I will keep it on the sidelines and just try and max out my fiancés and my Roth's next year.

Debts and Liabilities - Vehicle and Credit still high

Credit Cards: All of this is still the engagement credit card with a 12 month 0% APR, I am not going to put much of a dent into this debt until the 12 month or January/February, when I will pay it off in full. I have that money going straight into my saving account creating a little interest off of it till I pay it in full.

Car Loan: See last month with starting to think abut paying it off in full at some point—This will probably be next year, as I don't want to take that big of chunk of saving out for it t the moment. I am paying 4% APR on it so I am paying a little but not a ton. Still looking to pay it off early-will probably be a goal next ear.

So overall October was a good month. Still kicking up the saving as I have wedding and honeymoon expenses coming down the line.

Thursday, October 29, 2009

Adding Gold Stocks to Portfolio

So this week I have added some Gold stocks to the mix. Honestly, it is a tad bit scary, as I have only recently been researching gold. Commodities in general kinda freak me out, but this move is something that I truly believe in. I have been following every camp from inflationist, deflationist and stagflationist and even reflationist. I realize that some are calling for a gold bubble and that it could all come crashing down. Personally do see it that way, but I take that into consideration. I think of it more as a hedge against everything. The more I research gold and look into it, I believe I will always keep a percentage of my portfolio as precious metals.

I think that with all the economic turmoil and the continuation of the Fed's total disregard for the dollar that at least I need to protect a certain amount of my cash I have sitting around.

I haven't yet, pulled the trigger on purchasing hard gold or silver. I have been checking it out though.

I like to believe I will always be a saver and that any purchase of hard gold/silver will be the protection of my wealth. As a saver I believe in gold, and the value your wealth has attached to it. Again I would not buy gold as an investment, but more of safe haven of my wealth (which hopefully I will have one day!)

So, I have added a small bit of (AUY, GLD, EGO) and will be showing up in my net worth this coming week.

I think that with all the economic turmoil and the continuation of the Fed's total disregard for the dollar that at least I need to protect a certain amount of my cash I have sitting around.

I haven't yet, pulled the trigger on purchasing hard gold or silver. I have been checking it out though.

I like to believe I will always be a saver and that any purchase of hard gold/silver will be the protection of my wealth. As a saver I believe in gold, and the value your wealth has attached to it. Again I would not buy gold as an investment, but more of safe haven of my wealth (which hopefully I will have one day!)

So, I have added a small bit of (AUY, GLD, EGO) and will be showing up in my net worth this coming week.

Labels:

Atlas Shrugged,

Bailouts,

Currency,

FED,

Gold,

Government,

Money Management,

saving

Wednesday, October 14, 2009

Tuesday, October 13, 2009

Cash For Clunker Revisited

If you traded in a clunker worth $3500, you get $4500 off for an apparent "savings" of $1000.

However, you have to pay taxes on the $4500 come April 15th (something that no auto dealer will tell you). If you are in the 30% tax bracket, you will pay $1350 on that $4500.

So, rather than save $1000, you actually pay an extra $350 to the feds. In addition, you traded in a car that was most likely paid for. Now you have 4 or 5 years of payments on a car that you did not need, that was costing you less to run than the payments that you will now be making.

But wait, it gets even better: you also got ripped off by the dealer.

For example, most dealers in LA was selling the Ford Focus with all the goodies including A/C, auto transmission, power windows, etc for $12,500 the month before the "cash for clunkers" program started.

When "cash for clunkers" came along, they stopped discounting them and instead sold them at the list price of $15,500. So, you paid $3000 more than you would have the month before. (Honda, Toyota , and Kia played the same list price game that Ford and Chevy did).

So lets do the final tally here:

You traded in a car worth: $3500

You got a discount of: $4500

---------

Net so far +$1000

But you have to pay: $1350 in taxes on the $4500

--------

Net so far: -$350

And you paid: $3000 more than the car was selling for

the month before

----------

Net -$3350

We could also add in the additional taxes (sales tax, state tax, etc.) on the extra $3000 that you paid for the car, along with the 5 years of interest on the car loan but lets just stop here.

So who actually made out on the deal? The feds collected taxes on the car along with taxes on the $4500 they "gave" you. The car dealers made an extra $3000 or more on every car they sold along with the kickbacks from the manufacturers and the loan companies. The manufacturers got to dump lots of cars they could not give away the month before. And the consumer got saddled with even more debt that they cannot afford.

Your government convinced the consumer that he was getting $4500 in "free" money from the "government" when in fact Joe was giving away his $3500 car and paying an additional $3350 for the privilege.

When will we wake up?

However, you have to pay taxes on the $4500 come April 15th (something that no auto dealer will tell you). If you are in the 30% tax bracket, you will pay $1350 on that $4500.

So, rather than save $1000, you actually pay an extra $350 to the feds. In addition, you traded in a car that was most likely paid for. Now you have 4 or 5 years of payments on a car that you did not need, that was costing you less to run than the payments that you will now be making.

But wait, it gets even better: you also got ripped off by the dealer.

For example, most dealers in LA was selling the Ford Focus with all the goodies including A/C, auto transmission, power windows, etc for $12,500 the month before the "cash for clunkers" program started.

When "cash for clunkers" came along, they stopped discounting them and instead sold them at the list price of $15,500. So, you paid $3000 more than you would have the month before. (Honda, Toyota , and Kia played the same list price game that Ford and Chevy did).

So lets do the final tally here:

You traded in a car worth: $3500

You got a discount of: $4500

---------

Net so far +$1000

But you have to pay: $1350 in taxes on the $4500

--------

Net so far: -$350

And you paid: $3000 more than the car was selling for

the month before

----------

Net -$3350

We could also add in the additional taxes (sales tax, state tax, etc.) on the extra $3000 that you paid for the car, along with the 5 years of interest on the car loan but lets just stop here.

So who actually made out on the deal? The feds collected taxes on the car along with taxes on the $4500 they "gave" you. The car dealers made an extra $3000 or more on every car they sold along with the kickbacks from the manufacturers and the loan companies. The manufacturers got to dump lots of cars they could not give away the month before. And the consumer got saddled with even more debt that they cannot afford.

Your government convinced the consumer that he was getting $4500 in "free" money from the "government" when in fact Joe was giving away his $3500 car and paying an additional $3350 for the privilege.

When will we wake up?

Friday, October 9, 2009

Gold and Economic Freedom

So you think Gold shouldn't be in your portfolio? See what ex-fed chairman Alan Greenspan wrote 1967. I learned a great deal reading this article.

In order to understand the source of their antagonism, it is necessary first to understand the specific role of gold in a free society.

Money is the common denominator of all economic transactions. It is that commodity which serves as a medium of exchange, is universally acceptable to all participants in an exchange economy as payment for their goods or services, and can, therefore, be used as a standard of market value and as a store of value, i.e., as a means of saving.

The existence of such a commodity is a precondition of a division of labor economy. If men did not have some commodity of objective value which was generally acceptable as money, they would have to resort to primitive barter or be forced to live on self-sufficient farms and forgo the inestimable advantages of specialization. If men had no means to store value, i.e., to save, neither long-range planning nor exchange would be possible.

What medium of exchange will be acceptable to all participants in an economy is not determined arbitrarily. First, the medium of exchange should be durable. In a primitive society of meager wealth, wheat might be sufficiently durable to serve as a medium, since all exchanges would occur only during and immediately after the harvest, leaving no value-surplus to store. But where store-of-value considerations are important, as they are in richer, more civilized societies, the medium of exchange must be a durable commodity, usually a metal. A metal is generally chosen because it is homogeneous and divisible: every unit is the same as every other and it can be blended or formed in any quantity. Precious jewels, for example, are neither homogeneous nor divisible. More important, the commodity chosen as a medium must be a luxury. Human desires for luxuries are unlimited and, therefore, luxury goods are always in demand and will always be acceptable. Wheat is a luxury in underfed civilizations, but not in a prosperous society. Cigarettes ordinarily would not serve as money, but they did in post-World War II Europe where they were considered a luxury. The term "luxury good" implies scarcity and high unit value. Having a high unit value, such a good is easily portable; for instance, an ounce of gold is worth a half-ton of pig iron.

In the early stages of a developing money economy, several media of exchange might be used, since a wide variety of commodities would fulfill the foregoing conditions. However, one of the commodities will gradually displace all others, by being more widely acceptable. Preferences on what to hold as a store of value, will shift to the most widely acceptable commodity, which, in turn, will make it still more acceptable. The shift is progressive until that commodity becomes the sole medium of exchange. The use of a single medium is highly advantageous for the same reasons that a money economy is superior to a barter economy: it makes exchanges possible on an incalculably wider scale.

Whether the single medium is gold, silver, seashells, cattle, or tobacco is optional, depending on the context and development of a given economy. In fact, all have been employed, at various times, as media of exchange. Even in the present century, two major commodities, gold and silver, have been used as international media of exchange, with gold becoming the predominant one. Gold, having both artistic and functional uses and being relatively scarce, has significant advantages over all other media of exchange. Since the beginning of World War I, it has been virtually the sole international standard of exchange. If all goods and services were to be paid for in gold, large payments would be difficult to execute and this would tend to limit the extent of a society's divisions of labor and specialization. Thus a logical extension of the creation of a medium of exchange is the development of a banking system and credit instruments (bank notes and deposits) which act as a substitute for, but are convertible into, gold.

A free banking system based on gold is able to extend credit and thus to create bank notes (currency) and deposits, according to the production requirements of the economy. Individual owners of gold are induced, by payments of interest, to deposit their gold in a bank (against which they can draw checks). But since it is rarely the case that all depositors want to withdraw all their gold at the same time, the banker need keep only a fraction of his total deposits in gold as reserves. This enables the banker to loan out more than the amount of his gold deposits (which means that he holds claims to gold rather than gold as security of his deposits). But the amount of loans which he can afford to make is not arbitrary: he has to gauge it in relation to his reserves and to the status of his investments.

When banks loan money to finance productive and profitable endeavors, the loans are paid off rapidly and bank credit continues to be generally available. But when the business ventures financed by bank credit are less profitable and slow to pay off, bankers soon find that their loans outstanding are excessive relative to their gold reserves, and they begin to curtail new lending, usually by charging higher interest rates. This tends to restrict the financing of new ventures and requires the existing borrowers to improve their profitability before they can obtain credit for further expansion. Thus, under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth.

When gold is accepted as the medium of exchange by most or all nations, an unhampered free international gold standard serves to foster a world-wide division of labor and the broadest international trade. Even though the units of exchange (the dollar, the pound, the franc, etc.) differ from country to country, when all are defined in terms of gold the economies of the different countries act as one -- so long as there are no restraints on trade or on the movement of capital. Credit, interest rates, and prices tend to follow similar patterns in all countries. For example, if banks in one country extend credit too liberally, interest rates in that country will tend to fall, inducing depositors to shift their gold to higher-interest paying banks in other countries. This will immediately cause a shortage of bank reserves in the "easy money" country, inducing tighter credit standards and a return to competitively higher interest rates again.

A fully free banking system and fully consistent gold standard have not as yet been achieved. But prior to World War I, the banking system in the United States (and in most of the world) was based on gold and even though governments intervened occasionally, banking was more free than controlled. Periodically, as a result of overly rapid credit expansion, banks became loaned up to the limit of their gold reserves, interest rates rose sharply, new credit was cut off, and the economy went into a sharp, but short-lived recession. (Compared with the depressions of 1920 and 1932, the pre-World War I business declines were mild indeed.) It was limited gold reserves that stopped the unbalanced expansions of business activity, before they could develop into the post-World War I type of disaster. The readjustment periods were short and the economies quickly reestablished a sound basis to resume expansion.

But the process of cure was misdiagnosed as the disease: if shortage of bank reserves was causing a business decline-argued economic interventionists -- why not find a way of supplying increased reserves to the banks so they never need be short! If banks can continue to loan money indefinitely -- it was claimed -- there need never be any slumps in business. And so the Federal Reserve System was organized in 1913. It consisted of twelve regional Federal Reserve banks nominally owned by private bankers, but in fact government sponsored, controlled, and supported. Credit extended by these banks is in practice (though not legally) backed by the taxing power of the federal government. Technically, we remained on the gold standard; individuals were still free to own gold, and gold continued to be used as bank reserves. But now, in addition to gold, credit extended by the Federal Reserve banks ("paper reserves") could serve as legal tender to pay depositors.

When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage. More disastrous, however, was the Federal Reserve's attempt to assist Great Britain who had been losing gold to us because the Bank of England refused to allow interest rates to rise when market forces dictated (it was politically unpalatable). The reasoning of the authorities involved was as follows: if the Federal Reserve pumped excessive paper reserves into American banks, interest rates in the United States would fall to a level comparable with those in Great Britain; this would act to stop Britain's gold loss and avoid the political embarrassment of having to raise interest rates.

The "Fed" succeeded; it stopped the gold loss, but it nearly destroyed the economies of the world in the process. The excess credit which the Fed pumped into the economy spilled over into the stock market -- triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed. Great Britain fared even worse, and rather than absorb the full consequences of her previous folly, she abandoned the gold standard completely in 1931, tearing asunder what remained of the fabric of confidence and inducing a world-wide series of bank failures. The world economies plunged into the Great Depression of the 1930's.

With a logic reminiscent of a generation earlier, statists argued that the gold standard was largely to blame for the credit debacle which led to the Great Depression. If the gold standard had not existed, they argued, Britain's abandonment of gold payments in 1931 would not have caused the failure of banks all over the world. (The irony was that since 1913, we had been, not on a gold standard, but on what may be termed "a mixed gold standard"; yet it is gold that took the blame.) But the opposition to the gold standard in any form -- from a growing number of welfare-state advocates -- was prompted by a much subtler insight: the realization that the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state). Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes. A substantial part of the confiscation is effected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.

Under a gold standard, the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government's promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets. A large volume of new government bonds can be sold to the public only at progressively higher interest rates. Thus, government deficit spending under a gold standard is severely limited. The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. They have created paper reserves in the form of government bonds which -- through a complex series of steps -- the banks accept in place of tangible assets and treat as if they were an actual deposit, i.e., as the equivalent of what was formerly a deposit of gold. The holder of a government bond or of a bank deposit created by paper reserves believes that he has a valid claim on a real asset. But the fact is that there are now more claims outstanding than real assets. The law of supply and demand is not to be conned. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise. Thus the earnings saved by the productive members of the society lose value in terms of goods. When the economy's books are finally balanced, one finds that this loss in value represents the goods purchased by the government for welfare or other purposes with the money proceeds of the government bonds financed by bank credit expansion.

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

--Alan Greenspan

1967

Source: http://www.usagold.com/gildedopinion/greenspan.html

What do you think? Please leave me a comment!

Labels:

Atlas Shrugged,

Currency,

FED,

Free Market,

Gold,

Government,

Money,

Ron Paul,

taxes

Friday, October 2, 2009

September 09 Net Worth: Back on the Train

September was a another good month for me, even though I had a few major events. This included weekend trips to New York and Atlanta, property taxes, and three fantasy football leagues. Seems like every month I have some major expense I haven't accounted for come up and it is really hurting my savings I believe. I am guessing with the holidays and everything else the next few are not going to be so kind to me either. But over all I am back in the black after an accounting mistake last month. Overall up 6.37%, pretty nice since I thought the stock market was going to get hit severely. I still believe that the next few months are going to be hard time for the market and thus my networth? We will see

September was a another good month for me, even though I had a few major events. This included weekend trips to New York and Atlanta, property taxes, and three fantasy football leagues. Seems like every month I have some major expense I haven't accounted for come up and it is really hurting my savings I believe. I am guessing with the holidays and everything else the next few are not going to be so kind to me either. But over all I am back in the black after an accounting mistake last month. Overall up 6.37%, pretty nice since I thought the stock market was going to get hit severely. I still believe that the next few months are going to be hard time for the market and thus my networth? We will seeLets break it down:

Cash & Savings: Had a few expensive weekends, plane tickets, hotel room that put a damper on this months budget, including fantasy football. Overall though I still saved a little and had a huge month in spending, so overall I cannot complain, I will be looking to have a big month in October. This bracket holds the funds for my down payment on house(which is currently on hold again), engagement ring, insurance, auto maintenance, Roth IRA(before I max it out), and vacation. This is why it can be a little deceiving, it also holds my monthly budget in it. It has about 16-17k sitting around as savings the rest are funds that are going to be used at some point over the year. The rest is used on a daily bases for covering expenses, rent, food, auto, etc...

Stocks/Brokerage: This shrunk a little bit as I sold off some stocks. My employee stock option plan is seeing some small growth but seems to be up and down all the time. Right now besides that company stock I am still shorting the financial's and as of right now it is a wealth destroyer but I don't have enough to make a huge difference.

Retirement 401k: This braket is just me adding money to my 401k every month. Not seeing much growth here this last month. I have rolled my old 401k over to a IRA so will be moving it to the Retirement IRA's bracket below. I not really checking on this bracket as it really long term and I just keep pumping money into it every paycheck.

Retirement IRA's: Had a big month which saw a gain of around $400.00 - wow if I could have some months like that I would be able to see my wealth grow tremendously! Anyways still have a big chunk of cash sitting on the sidelines which I have been thinking of dollar cost averaging into, as I am still trying to max out my Roth this year.

Debts and Liabilities - Vehicle and Credit still high

Credit Cards: Most of this is still the engagement credit card with a 12 month 0% APR, I am not going to put much of a dent into this debt until the 12 month, when I will pay it off in full. I have that money going straight into my saving account creating a little interest off of it till I pay it in full. There was a little jump in debt but it is sorta in between stage, we purchased flights up to NYC and the furniture is on the credit card but all will be paid in full before interest is assessed.

Car Loan: See last month

So overall September was a good month. Looking to have a big month in October as things slow down a little bit and not so many expensive weekends. I really need to kick up the saving as I have wedding and honeymoon expenses coming down the line.

Related Post:

Thursday, October 1, 2009

Tuesday, September 29, 2009

Where will capital flow during a time of a systemic crisis? Since 1971, capital has moved up this chart. Now it is reversing. Capital will flow into government bonds , treasury bills, physical cash, and ultimately its final home , gold. - via ZeroHedge

Alexander the Great, tutored by Aristotle, perhaps the richest and most powerful man in the world before the age of 33, was interred in a gold sarcophagus and solid gold casket filled with honey and transported by a solid gold chariot to a solid gold mausoleum in Memphis. It did not take long for various Ptolemy successors to steal the gold and move the body to Alexandria to put it on display under glass, with gold thefts every time it was moved or displayed.

Practically every war included the surreptitious movement of gold from the vanquished to the conquerors, providing stories of Chinese, Indian, Mesopotamian, Egyptian, Israel, Knights Templar, Arabic, Spanish, French, Revolutionary, Civil War, Philippines, Nazi, Korean, Vietnamese and Iraqi gold hoards accompanying inflation.

Since gold is ultimate money and power, is it any surprise Mercantilist Bankers and Treasurers tried for many thousands of years to get or control it?

This is a great conversation going over at ZeroHedge - I suggest you read this post along with all the comments.

Alexander the Great, tutored by Aristotle, perhaps the richest and most powerful man in the world before the age of 33, was interred in a gold sarcophagus and solid gold casket filled with honey and transported by a solid gold chariot to a solid gold mausoleum in Memphis. It did not take long for various Ptolemy successors to steal the gold and move the body to Alexandria to put it on display under glass, with gold thefts every time it was moved or displayed.

Practically every war included the surreptitious movement of gold from the vanquished to the conquerors, providing stories of Chinese, Indian, Mesopotamian, Egyptian, Israel, Knights Templar, Arabic, Spanish, French, Revolutionary, Civil War, Philippines, Nazi, Korean, Vietnamese and Iraqi gold hoards accompanying inflation.

Since gold is ultimate money and power, is it any surprise Mercantilist Bankers and Treasurers tried for many thousands of years to get or control it?

This is a great conversation going over at ZeroHedge - I suggest you read this post along with all the comments.

Thursday, September 24, 2009

Surfing, To Big To Fail, and Capitalism

*Monday December 5th, 2005 was a dark day at shaping bays and in surf shops around the country. Orange County-based Clark Foam -- far and away the world's largest supplier of surfboard blanks -- shut its doors after over 45 years in business due to a series of ongoing environmental and safety concerns.

*It's estimated that 90% of the world's blanks came from Clark Foam. Sure, there are other blank manufactures in Australia and a few here in the US, but no one is prepared to deal with the huge gap left by Clark Foam's closure. Surfboard prices will go up overnight and shapers still aren't quite sure what will happen next.

*Some folks think Clark Foam's closure is the beginning of the end.

*Grubby Clark, sole owner of Clark Foam and its patents, could throw in the towel on his long-standing battle with the EPA, effectively starting the board-building Great Depression. Can you say Black Monday?

*“This could be the surfboard industry’s H-Bomb,” says Randy Adler “I can’t even imagine how many people this will affect.”

*“This is going to affect everyone,” says a stunned Bob Hurley, of Hurley International

*Even those more apt to look for silver linings are having a tough time with this one. Overnight, the careers of hundreds of shapers and glassers across the globe are effectively over.

These were just some of the stories coming out that day in December 2005. The surf world had come to a stand still. Clark foam, the too big to fail in the surf industry had been pressured to shut its door by the United States Environmental Protection Agency. It was a shock to the system for sure, overnight the prices of surfboards had doubled and tripled, there was a panic from the industry. The future of surfboard building was uncertain, how was the industry going to survive?

In 2005 the economy was booming (bubbling), life was good, and the government did not bail out companies/industries that went out of business, especially the ones that were forced to quit by the government. Clark invented the polyurethane foam and blank designs used by surfboard shapers worldwide, in what was estimated to be a $200 million dollar (USD) industry in the U.S. alone. How could we allow a $200 million dollar industry to be so effected without the help of the government? If it was 2009, and we treated Clark Foam like the to big to fail companies of today, we the tax payers would give money to restructure, re-innovate and create something new and environmental friendly, whatever it took to be viable.

Well, government never stepped in and Capitalism roared it strength in the early first half of 2006 when shock gave away to opportunity. Diverse groups of entrepreneurs and suppliers quickly adapted and filled the void. Not only did new polyurethane companies step up, but alternative technologies popped up at a recorded setting pace. The surfing industry today is still seeing new technologies, which has pushed the sport to new levels. If you do not believe me read this article, excerpt from article:

“In the four months following the Clark closure, startup Just Foam (San Clemente, Calif.) grew from 3 to 26 employees and from 25 to 150 blanks produced daily on the strength of founder/president Scott Saunders' proprietary hybrid-TDI chemistry, which reportedly meets environmental regulations with unusually low VOC emissions.”

“In one of the more unusual developments, researchers at Sandia National Laboratories (Livermore, Calif.) are marketing TufFoam, a low-density, water-blown, modified MDI/polyether urethane foam.”

Gary Linden, now operations manager of Walker Foam (Wilmington, Calif.), a long-time Clark Foam competitor, admits that Clark's were some of the best engineered blanks in the world, but believes that Walker's TDI-based polyether urethane is denser, with better cell bonding.”

These are just a few of the examples...

With Clark Foam, polyurethane was roughly 90% of what surfboards were made of back then. Since the collapse, polyurethane has become more environmentally safe. Other new technologies including polystyrene, expanded polypropylene, compression molded, hollow(using aerospace composite technology), carbon fiber, and polyfoam have all come to the forefront in 4 short years. Each bringing with them lighter, stronger, and more durable surfboards, not to mention better performance, including Firewire—my preference in surfboards.

Unfortunately for America we have missed this opportunity for capitalism to step in. We have missed out on smaller, more innovating companies coming to the forefront and leading us out of this recession. To take us into new heights, producing new and better technologies. We have missed out on those same smaller companies to grow and to expand, to create new jobs for the unemployed. Instead we are stuck with the same companies that have made bad business decisions after bad decision while producing bad products. Now that they have the government on their sides they are "supposedly" starting to change their act, this time with the unlimited backing of us, the taxpayers.

Capitalism is a beautiful thing when is it given the opportunity to flourish. It is a shame that we are at a place which is a total distortion of capitalism. This is just the beginning, from here on out, it is going to be even harder. With the greed on wall street, the media, and the **sheeple that will hang onto Michael Moore's new movie "Capitalism", which will distort it even farther. I am sure that he will twist the movie to show that capitalism caused the economy to collapse. I believe he will not speak on that crony capitalism was the reason.

Please understand...Capitalism is not perfect, but it by far the best economic system we have and it is not an opinion, a theory, or hope. Captain Capitalism says it best:

Our ideology is based in truth. What makes us capitalists, and free-marketers, is the fact that our belief in capitalism is not a belief at all, but rather a knowledge, a knowing that capitalism is the best system. And it is because the truth forms our ideology, that capitalism will always surpass socialism and communism as economic systems.

Please pass along to anyone who has any doubts about capitalism and the theory of "To Big To Fail", as they obviously do not know America and what has made this such a great country.

**Sheeple - It is often used to denote persons who voluntarily acquiesce to a perceived authority, or suggestion without sufficient research to understand fully the scope of the ramifications involved in that decision, and thus undermine their own human individuality or in other cases give up certain rights. The implication of sheeple is that as a collective, people believe whatever they are told, especially if told so by a perceived authority figure believed to be trustworthy, without processing it or doing adequate research to be sure that it is an accurate representation of the real world around them.

Great Article from Entrepreneur Magazine about Firewire surfboards:

http://www.firewiresurfboards.com/pdf/EntrepreneurMag.PDF

*Quotes from the following articles:

http://www.surfline.com/surfnews/article.cfm?id=1618

http://www.surfingmagazine.com/news/surfing-pulse/clark-foam-120505/

http://www.surfermag.com/features/onlineexclusives/clarkfoam/

http://www.firewiresurfboards.com/pdf/EntrepreneurMag.PDF

*Quotes from the following articles:

http://www.surfline.com/surfnews/article.cfm?id=1618

http://www.surfingmagazine.com/news/surfing-pulse/clark-foam-120505/

http://www.surfermag.com/features/onlineexclusives/clarkfoam/

photo by RB surfboards

Feel free to leave me a comment and let me know your thoughts!

Thursday, September 17, 2009

Ron Paul Q&A: Audit the Fed, Then End It

Reprinted from The Wall Street Journal

What would a world without the Fed look like?

You’d go back to the day that if you wanted to borrow money to build a house, somebody would’ve had to save some money. You wouldn’t have zero savings and all the credit in the world. That’s just a total distortion of capitalism. Capital comes from savings. The part you don’t use for everyday living which you have left over, you reinvest and you save or you loan it out. We were living with something absolutely bizarre that had nothing to do with capitalism. We had no savings whatsoever yet there was all the credit in the world.

So without the Fed, there wouldn’t be as much credit.

Yeah, it would be different. If you were selling me a car and the car was worth $10,000 and I didn’t want to pay cash, you could take credit from me. You’ve got to have something to measure it by. What is a dollar? We don’t even know what a dollar is. There’s no definition for a dollar. There’s never been a time in law that said a Federal Reserve note is a dollar. That’s the basic flaw. There’s no definition for money. We’ve built a worldwide economy on a measuring rod that varies every single day. That’s why it was fragile, and that’s why it collapsed. There was no soundness to it. So that’s why you have to have a stable unit of account.

If you live in a primitive society, you’d trade goods. And if you wanted to advance, then you would trade a universal good, which would be a coin. But we’ve become sophisticated and smart and say, ‘Oh, you don’t have to go through that. We’ll just print the money. And we’ll trust the government not to print too much, and distribute it fairly.’ That’s often just a total farce. People are realizing that it is.

Don’t you think the Fed has moderated the business cycle over the past century?

Yes, I think they did smooth things out. The market’s always demanding the correction of the malinvestment and the excessive debt. … Since Bretton Woods broke down, I think every recession has been moderated by the Fed. That’s why the trust kept being built. That’s all a negative. You have to get rid of the mistakes. Moderating it means that we have slowed up the correction. The fact that they have been successful is probably the worst part about it. They’re moderating the rapidity of the crash and the correction by holding the mistakes in place.

What if, years from now, we see that the Fed has returned its balance sheet to its old size and pulled that money back from the system? Would that not be a validation of its approach?

There has only been one time that I know of where they have done that significantly, to withdraw anything of significance. That was after the Civil War. They withdrew greenbacks to a degree, they quit printing greenbacks, and they balanced the budget. I don’t think you can find any other time in our history and probably the history of the world. Because it’s an addiction, and the withdrawal is always much more serious than the continuation. The immediate problem of continuing the inflation is always more acceptable than withdrawal symptoms. Politically there will be continued inflation until it self-destructs.

So you don’t think it’s possible to pull it off?

They might try a little bit. With a weak economy, they’ll say it’s better for the economy to have low interest rates. If we didn’t have a Federal Reserve today, interest rates might be market driven. A lot of people would go bankrupt, but it would benefit the people who save. Capitalism is supposed to benefit the people who save. Even though they’re cheating the people who save, they’re cheating those on fixed income and the elderly, they will not quit inflating. The pain will be too great. They’re smart enough to know? They weren’t smart enough to know when they printed. They created the bubble. All of a sudden they’re going to get smart enough to know when to withdraw this? There’s not one chance in a million that’s going to happen.

But if the Fed were to pull this off and return its balance sheet to a normal size, where would that leave you?

If they were able to shrink their assets by 50%, to a trillion dollars or so … I would say it would challenge a lot of people. But I think the economic laws are in place. It’s only going to be temporary. It’s not going to happen. The only way you could do that is what I’ve been advocating for these last several years. You’ve got to cut spending, you’ve got to balance the budget, you’ve got to stop fighting these wars, you’ve got to bring our troops home, you’ve got to quit expanding the welfare state here at home… But I just don’t think the conditions exist. In theory you could, but if you do that without shrinking the size of the government and shrinking the deficit, it will be disastrous. It won’t work.

How would an audit lead to ending the Fed?

It’s a stepping stone. I think what’s going to lead to the next step is the destruction of the dollar, just like economic events moved further ahead than my legislative process. I wasn’t getting anywhere. But the economic events demanded that we look into it. So even if this bill passes and we have more information and we’re talking about monetary policy reform, I don’t think that’s the way this system is going to be ended. I think it’ll be ended when it’s a total failure and then it’ll have to be replaced by something. It could be replaced with a more authoritarian government, a more socialistic government.

Do you think the Fed will be abolished during your career?

I always thought the day would come… This economy is going to get worse and this dollar is going to get a lot worse. It’ll take care of itself. My real goal is educating people to the nature of money so that when this system fails, that they’ll know what to do and not just say ‘Well, we need a better manager.’

For three decades, Rep. Ron Paul has waged a lonely battle in Congress to abolish the Federal Reserve. But he has more foot soldiers across the nation today, particularly after the financial crisis, who are leading the drive for wider congressional audits of the central bank.

What would a world without the Fed look like?

You’d go back to the day that if you wanted to borrow money to build a house, somebody would’ve had to save some money. You wouldn’t have zero savings and all the credit in the world. That’s just a total distortion of capitalism. Capital comes from savings. The part you don’t use for everyday living which you have left over, you reinvest and you save or you loan it out. We were living with something absolutely bizarre that had nothing to do with capitalism. We had no savings whatsoever yet there was all the credit in the world.

So without the Fed, there wouldn’t be as much credit.

Yeah, it would be different. If you were selling me a car and the car was worth $10,000 and I didn’t want to pay cash, you could take credit from me. You’ve got to have something to measure it by. What is a dollar? We don’t even know what a dollar is. There’s no definition for a dollar. There’s never been a time in law that said a Federal Reserve note is a dollar. That’s the basic flaw. There’s no definition for money. We’ve built a worldwide economy on a measuring rod that varies every single day. That’s why it was fragile, and that’s why it collapsed. There was no soundness to it. So that’s why you have to have a stable unit of account.

If you live in a primitive society, you’d trade goods. And if you wanted to advance, then you would trade a universal good, which would be a coin. But we’ve become sophisticated and smart and say, ‘Oh, you don’t have to go through that. We’ll just print the money. And we’ll trust the government not to print too much, and distribute it fairly.’ That’s often just a total farce. People are realizing that it is.

Don’t you think the Fed has moderated the business cycle over the past century?

Yes, I think they did smooth things out. The market’s always demanding the correction of the malinvestment and the excessive debt. … Since Bretton Woods broke down, I think every recession has been moderated by the Fed. That’s why the trust kept being built. That’s all a negative. You have to get rid of the mistakes. Moderating it means that we have slowed up the correction. The fact that they have been successful is probably the worst part about it. They’re moderating the rapidity of the crash and the correction by holding the mistakes in place.

What if, years from now, we see that the Fed has returned its balance sheet to its old size and pulled that money back from the system? Would that not be a validation of its approach?

There has only been one time that I know of where they have done that significantly, to withdraw anything of significance. That was after the Civil War. They withdrew greenbacks to a degree, they quit printing greenbacks, and they balanced the budget. I don’t think you can find any other time in our history and probably the history of the world. Because it’s an addiction, and the withdrawal is always much more serious than the continuation. The immediate problem of continuing the inflation is always more acceptable than withdrawal symptoms. Politically there will be continued inflation until it self-destructs.

So you don’t think it’s possible to pull it off?

They might try a little bit. With a weak economy, they’ll say it’s better for the economy to have low interest rates. If we didn’t have a Federal Reserve today, interest rates might be market driven. A lot of people would go bankrupt, but it would benefit the people who save. Capitalism is supposed to benefit the people who save. Even though they’re cheating the people who save, they’re cheating those on fixed income and the elderly, they will not quit inflating. The pain will be too great. They’re smart enough to know? They weren’t smart enough to know when they printed. They created the bubble. All of a sudden they’re going to get smart enough to know when to withdraw this? There’s not one chance in a million that’s going to happen.

But if the Fed were to pull this off and return its balance sheet to a normal size, where would that leave you?

If they were able to shrink their assets by 50%, to a trillion dollars or so … I would say it would challenge a lot of people. But I think the economic laws are in place. It’s only going to be temporary. It’s not going to happen. The only way you could do that is what I’ve been advocating for these last several years. You’ve got to cut spending, you’ve got to balance the budget, you’ve got to stop fighting these wars, you’ve got to bring our troops home, you’ve got to quit expanding the welfare state here at home… But I just don’t think the conditions exist. In theory you could, but if you do that without shrinking the size of the government and shrinking the deficit, it will be disastrous. It won’t work.

How would an audit lead to ending the Fed?

It’s a stepping stone. I think what’s going to lead to the next step is the destruction of the dollar, just like economic events moved further ahead than my legislative process. I wasn’t getting anywhere. But the economic events demanded that we look into it. So even if this bill passes and we have more information and we’re talking about monetary policy reform, I don’t think that’s the way this system is going to be ended. I think it’ll be ended when it’s a total failure and then it’ll have to be replaced by something. It could be replaced with a more authoritarian government, a more socialistic government.

Do you think the Fed will be abolished during your career?

I always thought the day would come… This economy is going to get worse and this dollar is going to get a lot worse. It’ll take care of itself. My real goal is educating people to the nature of money so that when this system fails, that they’ll know what to do and not just say ‘Well, we need a better manager.’

Related Reading:

Wednesday, September 16, 2009

Thursday, September 10, 2009

The Forgotten Man of Socialized Medicine - Atlas Shrugged

The following is an excerpts from Atlas Shrugged, © Copyright, 1957, by Ayn Rand.

Related Links:

Friday, September 4, 2009

August 09 Net Worth: Autumn comes earlier

Autumn came a little earlier for me this year, August was the first down month I have had since April and only the second month this year I haven't seen growth. August just seemed to have a lot of cool and expensive weekends along with purchasing a new TV and piece of furniture for the TV. The major loss came in my 401k which I found was an accounting mistake by me. You might have noticed as well that I added "precious metals" under my assets because I am planning on buying some silver and some gold here. I will start small and see how it goes. It will not be a investment to make money but more of a way to start protecting and creating wealth.

Autumn came a little earlier for me this year, August was the first down month I have had since April and only the second month this year I haven't seen growth. August just seemed to have a lot of cool and expensive weekends along with purchasing a new TV and piece of furniture for the TV. The major loss came in my 401k which I found was an accounting mistake by me. You might have noticed as well that I added "precious metals" under my assets because I am planning on buying some silver and some gold here. I will start small and see how it goes. It will not be a investment to make money but more of a way to start protecting and creating wealth.Lets break it down:

Cash & Savings: This is mostly because I purchased a TV which we paid cash for and a new piece of furniture for it. I also had a long weekend in Chicago for a bachelors party where the money flowed like it grows on trees. Either way I still was able to save a few hundred so I cannot complain! This bracket holds the funds for my down payment on house(which is currently on hold again), engagement ring, insurance, auto maintenance, Roth IRA(before I max it out), and vacation. This is why it can be a little deceiving, it also holds my monthly budget in it. It has about 16-17k sitting around as savings the rest are funds that are going to be used at some point over the year. The rest is used on a daily bases for covering expenses, rent, food, auto, etc...

Stocks/Brokerage: This saw steady growth and I went to sell my my past employee stock and my account has a hold on it based of updating address and such from moving. I will be cashing out on that this month along with buying a few hundred dollars of FAZ (shorting the financial stocks) even though I have lost a bit with it.

Retirement 401k: As I have been saying if the dow hits 10k or end of september I will roll half of my old 401k into an IRA and let it sit in cash until we see a major pullback. When I went to transfer it to my Vanguard account, I saw where my actual amount was smaller than what the account said, based of not being fully vested with my old company. Not sure why it was showing me the fully vest amount, but it was and that was a $3000.00 difference, ouch!

Retirement IRA: Finally got over the $5000.00 mark! This should jump next month once I rollover my old 401k. Besides that nice steady growth is what I like to see.

Debts and Liabilities - Vehicle and Credit still high

Credit Cards: Most of this is still the engagement credit card with a 12 month 0% APR, I am not going to put much of a dent into this debt until the 12 month, when I will pay it off in full. I have that money going straight into my saving account creating a little interest off of it till I pay it in full. There was a little jump in debt but it is sorta in between stage, we purchased flights up to NYC and the furniture is on the credit card but all will be paid in full before interest is assessed.

Car Loan: Same story as last month...think I have stopped thinking about selling it.

So overall August was a bad month, but in the grand scheme of things, I like where I am at. September is already shaping up to be an expensive month. I have managed to lower my rent and get my cable bill reduced, so hopefully that will help slightly. I look to be on track the next couple of months and gain in my net worth if the stock market it can hold up. We will see next month!

Related Post:

Thursday, September 3, 2009

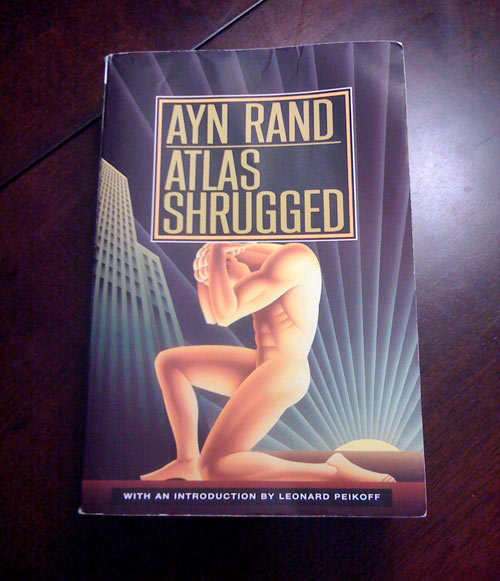

FREE BOOK: Atlas Shrugged Giveaway

As many of you know, I am a huge fan of Ayn Rand and especially Atlas Shrugged. This book changed my life in so many ways* when it comes to politics and government intervention. The events in the book are being played out everyday with our government. We live in an extraordinary time and right now is an amazing time to read/re-read this book to understand what all is happening. I am giving away one new copy of Atlas Shrugged to readers who leave a comment below. See how to win below...

*one which I do not agree with Rand is complete objectivism(religion), I lean more toward neo-objectivism based on my Christianity beliefs.

If you are not sure you want to read Atlas Shrugged, check out the Quote of the week section and see if it would be something interesting for you to read. It is over thousand pages and you have to read it slow to absorb everything, trust me you don't want to read it fast!

I am honored that a publicist from the The Ayn Rand Institute reached out to me and gave me a copy to give away to a lucky reader. She has been awesome with sending me articles and asking me if I want any interviews or editorial needs. You can find out more information on the The Ayn Rand Institute by clicking here.

To Win all you have to do is leave a comment and let me know why you are intrigued by Atlas Shrugged and why you would want to read it.

- Please leave only (1) comment below

- Contest will run for week and half till the weekend of Sept 12th, 2009

- Check back on 9/13 to see if you have won (I will also e-mail)

- Make sure your state allows you to win free prizes

Follow me on twitter @mymoneyshrugged

Subscribe to my RSS feed

Monday, August 31, 2009

Thomas Sowell: The Pattern of Failure

A coworker of mine who is a Ron Paul supporter gave me a book to read. Already 2 chapters into the book and it is blowing me away. The book is The Vision of the Anointed: Self-Congratulation as a Basis for Social Policy by Thomas Sowell

The interesting perspective I see is that it was written in 1996 and the ideas still apply today as they did in the past. I will give you an example how we are still seeing his thoughts played out. He starts off by pointing out the elitist, government-expanding crusaders share several key elements:

The following excepts are from The Vision of the Anointed by Thomas Sowell ©1996

1. Assertion of a great danger to the whole society, a danger to which the masses of people are oblivious.

2. An urgent need for government action to avert impending catastrophe.

3. A need for government to drastically curtail the dangerous behavior of the many, in response to the prescient conclusions of the few.

4. A disdainful dismissal of arguments to the contrary as either uninformed, irresponsible, or motivated by unworthy purposes.

He also points out patterns that have developed among the anointed for dealing with repeated failures of policies based on their vision.

Some situation exists, whose negative aspects the anointed propose to eliminate. Such a situation is routinely characterized as a "crisis," even though all human situations have negative aspects, and even though evidence is seldom asked or given to show how the situation at hand is either uniquely bad or threatening to get worse. Sometimes the situation described as a "crisis" has in fact already been getting better for years.

The "Solution"