Visit msnbc.com for breaking news, world news, and news about the economy

Wednesday, April 28, 2010

Tuesday, April 27, 2010

Big Government Rewards Failure

"Big government rewards failure, that's the way it sustains itself, it needs a constant failure as a way to justify its existence and expansion. It fails ultimately, but the saddest thing is, that before it happens, big government would suck a lot of resources from anything even distantly productive that the economy ends up completely destroyed with multiple generations of people being impoverished in this process."

Found in the comment section of one of the blogs I follow. In its simplest form, this statement sums up big government.

Found in the comment section of one of the blogs I follow. In its simplest form, this statement sums up big government.

Thursday, April 22, 2010

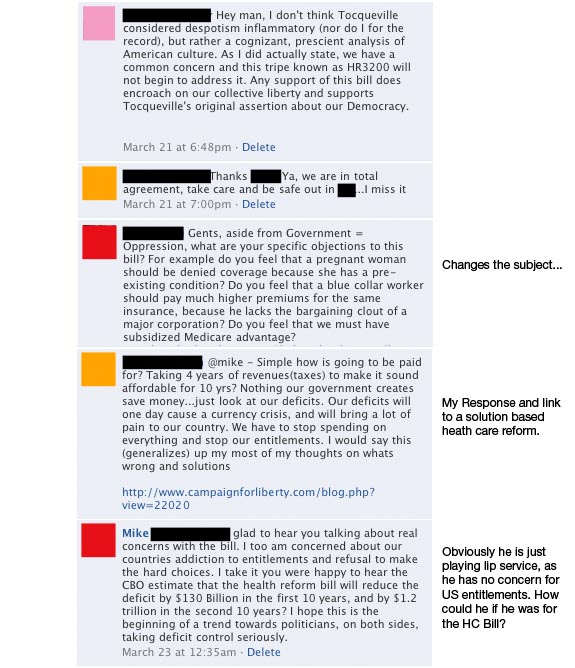

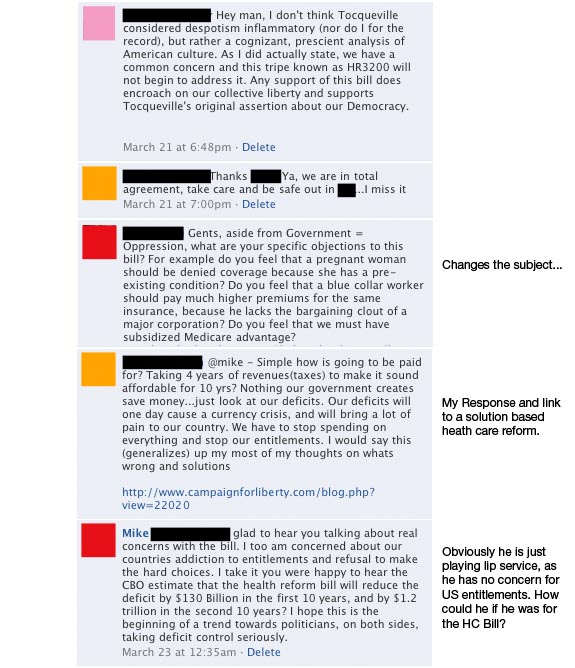

Debating a Lunatic

This is a debate I had over the heath care bill with a friend over facebook. Unfortunately, I feel we have a major problem in our country and I want to have an open minded debate and hear the other opinions to see if we can come to a common ground and start to fix the problem. I laid out my side to the best of my ability. This is what took place with commentary on the side...

I am the yellow square, I have a couple other friends jump in as well.

The only modifications of this exchange is the names, and any irrelevant discussion ie. Mike-"Let's get together and the first round is on me."

Please let me know what you think of this debate!

I am the yellow square, I have a couple other friends jump in as well.

The only modifications of this exchange is the names, and any irrelevant discussion ie. Mike-"Let's get together and the first round is on me."

Please let me know what you think of this debate!

Labels:

Debt,

Economic Collapse,

Freedom,

Government,

Lessons,

Liberty,

responsibility,

Tyranny

Thursday, April 15, 2010

Another Must Listen: Dr. Lawrence Parks

Dr. Lawrence Parks Executive Director Foundation of the Advancement of Monetary Education (FAME) Topic: Collapse of the Dollar

via: Financial Sense News Hour

via: Financial Sense News Hour

Labels:

Currency,

Debt,

Economic Collapse,

Economics,

FED,

Gold,

Government,

Money

Monday, April 12, 2010

Ron Paul at SRLC

Ron Paul is the type of leader/s we need in Washington. I am not sure why Ron Paul isn't more popular than he his? If anyone would just listen to him, they should see why he is the only guy in Washington making any sense. His is one of few that believes in The Constitution and let me leave you with this statement for the people that believe that The Constitution is a living and breathing document(that the document is old so we should just take the parts relevant to todays times):

"We are not sufficient of ourselves to stand against it, and if we knock down the law, the Constitution, to chase it with expediency and private justice, what will protect us when it turns around to devour us?

But we should never be a willing victim, and even worse, a silent bystander or mocking accomplice. This is why were you born here and now, to stand witness to the truth, as you can find it and value it above all else."-via Jesse

Friday, April 9, 2010

Tuesday, April 6, 2010

March 2010 Net Worth:50K! 100k On Deck

After a few months of saving a little more and trying to get over the $50,000.00 mark, we finally reach another goal. This month was a little crazy with having to pay close to $700.00 in vehicle maintenance. Along with having to pay for a few wedding things. The stock market is really the reason we jumped up this month. We are going to enjoy March because the next few months are not going to be a good to us(at least I believe)

After a few months of saving a little more and trying to get over the $50,000.00 mark, we finally reach another goal. This month was a little crazy with having to pay close to $700.00 in vehicle maintenance. Along with having to pay for a few wedding things. The stock market is really the reason we jumped up this month. We are going to enjoy March because the next few months are not going to be a good to us(at least I believe)Lets break it down:

Cash & Savings: Still smooth sailing with the cash savings, a nice little $1500.00 jump. I would love to have this growth every month. This has a few fund in it that we are saving instead of reinvesting. For the most part, this money grows from money directly transferred from paycheck to my money market. I do not see this money unless I have a big emergency. It is the money that we are saving for a downpayment on a house.

This bracket holds the funds for insurance, auto maintenance, Roth IRA, and vacation. This is why it can be a little deceiving, it also holds my monthly budget in it. It has about 13-15k sitting around as savings the rest are funds that are going to be used at some point over the year. The rest is used on a daily bases for covering expenses, rent, food, auto, etc...

Stocks/Brokerage: Stocks still seem to be slowly growing. I bought more stocks and sold out of my (FAZ). I have decided to hedge with commodities rather than a leveraged ETF. I bought the rare earth metals I was watching last month (AVARF). I purchased some Royal Gold Inc. (RGLD) at the end of the month as well. The other gold/silver and mining stocks and couple other random ones - (GLD)(SLV)(EGO)(AUY)(ZQK) ZDK finally took off after their earnings report, now I wish I owned more, it is up 103% since I bought it. I am one month from dollar cost averaging in silver every month. I believe that silver is going to be one of the best investments and that it could get up to $100 (spot).

As you can see I am heavy in commodities in my brokerage account. This is all based on my thought that over the next decade the best investments are going to actually be in hard assets. My Roth/IRA/401k are in pretty common index funds and mutual funds so I figure I can go more risky with brokerage. I believe these will out perform equities in the next decade and if nothing else I feel more comfortable with my portfolio diverse. I am bearish on the US Dollar and US Economy, I believe that trillion dollar deficits are not going bode well for the USA.

Retirement 401k: This braket is just me adding money to my 401k every month. Saw a nice little jump this month with the stock market. I'm not really checking on this bracket(daily/weekly) as it really long term and I just keep pumping money into it every paycheck.

Retirement IRA's: Slow growth here this month. I still think the market is going to correct itself. I will keep cash on the sidelines and just try and max out my fiancés and my Roth's next year. In this bracket I have all Vanguard Funds (VTSMX, VGSTX, VEIEX)

Debts and Liabilities - Vehicle under 10K!! Credit Cards done...

Credit Cards: This is just a more car maintenance along with purchase of airplane flights to a wedding that I put on credit, it will be paid off before I am charged - I pay off any Credit Card debt monthly.

Car Loan: I am paying 4% APR on it so I am paying a little, but not a ton. Still looking to pay it off early-will probably be a goal this or next ear. I ended paying near $458.00 dollars in interest last year, but still just contemplating paying off early. We are still saving up for a house so not sure its in our best interest to get rid of our cash sitting to be debt free on my vehicle.

March was another great month considering how bearish I am on the economy, sovereign debt, and our government. Next few months are going to remain crazy with all the wedding stuff with time and money so we will see how everything goes, would love to keep having months like this one.

Monday, April 5, 2010

Greenspan, Summers and Economy

"One cannot fight this sort of evil with hatred and violence, or hysteria and intemperate accusations, for these are its creatures, and it uses them always to further its ends. The only worthy adversary of the darkness is transparency, openness, justice, and truth based on facts, in the light of reason, with the guidance of the light of the world. We are not sufficient of ourselves to stand against it, and if we knock down the law, the Constitution, to chase it with expediency and private justice, what will protect us when it turns around to devour us? But we should never be a willing victim, and even worse, a silent bystander or mocking accomplice. This is why were you born here and now, to stand witness to the truth, as you can find it and value it above all else.

It is not easy to find the truth, as it is a journey, a way that never ends. And without a proper guide and companionship, it may be all too easy to grow weary or panic, and lose one's bearings and one's heart. But sometimes it is easier to discover where and what is not the truth by its acts, its results, the fruit that it produces, and the darkness and secrecy in which it dwells."

via Jesse's Café Américain

It is not easy to find the truth, as it is a journey, a way that never ends. And without a proper guide and companionship, it may be all too easy to grow weary or panic, and lose one's bearings and one's heart. But sometimes it is easier to discover where and what is not the truth by its acts, its results, the fruit that it produces, and the darkness and secrecy in which it dwells."

via Jesse's Café Américain

Labels:

Atlas Shrugged,

Banking,

Economic Collapse,

Economics,

FED,

Freedom,

stock market,

Tyranny

Subscribe to:

Comments (Atom)